Transaction Reconciliation System

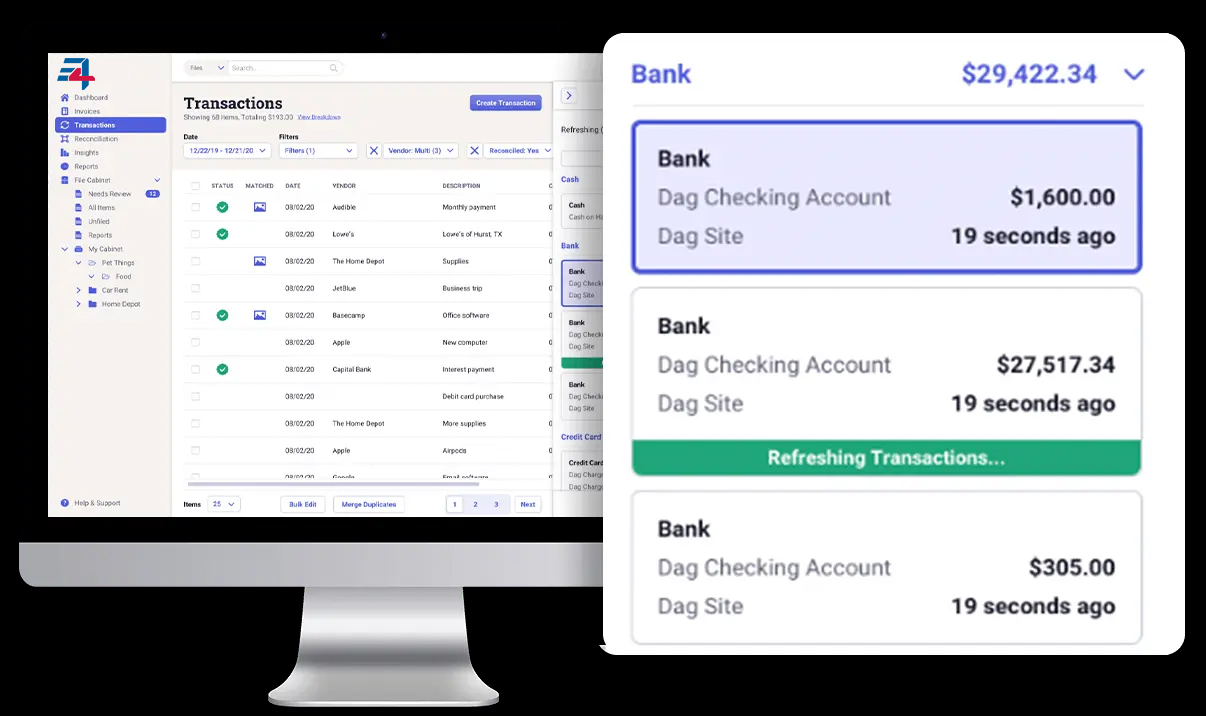

A Transaction Reconciliation System is a software solution designed to automate and streamline the process of reconciling financial transactions across various accounts, systems, or platforms. Its primary goal is to identify and resolve discrepancies in transaction records, ensuring that the financial data is accurate, complete, and compliant.

Here is a detailed description of key features and functionalities

- Data Import and Integration:

- Capability to import transaction data from various sources, such as bank statements, accounting systems, and other financial platforms.

- Integration with multiple data formats and protocols to accommodate diverse sources of financial information.

- Automated Matching Algorithms:

- Implementation of advanced matching algorithms to automatically compare and reconcile transactions based on predefined criteria, such as amount, date, and reference number.

- Intelligent reconciliation logic to identify and handle partial matches or variations in transaction details.

- Exception Handling:

- Robust exception management system to flag and investigate discrepancies or unmatched transactions.

- Workflow tools to route exceptions to designated personnel for manual review and resolution.

- Real-time Monitoring and Reporting:

- Real-time monitoring of reconciliation progress and status.

- Generation of comprehensive reports and dashboards to provide insights into reconciliation results, outstanding issues, and overall financial accuracy.

- Audit Trails and Compliance:

- Logging of all reconciliation activities to create a detailed audit trail.

- Compliance with regulatory requirements and industry standards, with the ability to demonstrate a thorough reconciliation process during audits.

- Flexible Reconciliation Rules:

- Configuration of reconciliation rules to adapt to specific business processes and requirements.

- Customization of matching criteria based on the nature of transactions and financial instruments.

- Integration with Accounting Systems:

- Seamless integration with accounting and ERP systems to ensure that reconciled data is updated across the organization's financial ecosystem.

- Scalability:

- Ability to handle a growing volume of transactions and increasing complexity as the organization expands.

- User Access Controls:

- Implementation of role-based access controls to restrict access to sensitive financial information and reconciliation processes.

- Notification and Alerts:

- Automated notifications and alerts for reconciliation milestones, exceptions, and pending actions to facilitate timely resolution.

A Transaction Reconciliation System is invaluable for organizations looking to enhance financial accuracy, improve operational efficiency, and maintain a high level of transparency and control over their financial processes. It plays a crucial role in mitigating financial risks and ensuring the integrity of financial data.